The 20% of the Economy That Drives 100% of Recessions

Why conventional analysis fails — and the three sectors you should actually be watching.

We often hear comments such as:

“The consumer is fine.”

“The consumer is holding up the economy.”

“We are a services economy.”

These comments are generally accepted as true, given the frequency that they are repeated, but the reality is that these statements are exactly the opposite of what you want to focus on if your goal is to track and get ahead of major changes in the Business Cycle.

Despite popular opinion, most segments of the economy do not contract and are generally extremely stable. That stability makes them useless for understanding where we are in the cycle—and where we’re headed next.

In this post, we’ll walk through the structure of the economy, explain why conventional analysis is always late to the major inflection points, and highlight the sequential Business Cycle framework we use at EPB Research to track the segments that actually drive every boom and bust.

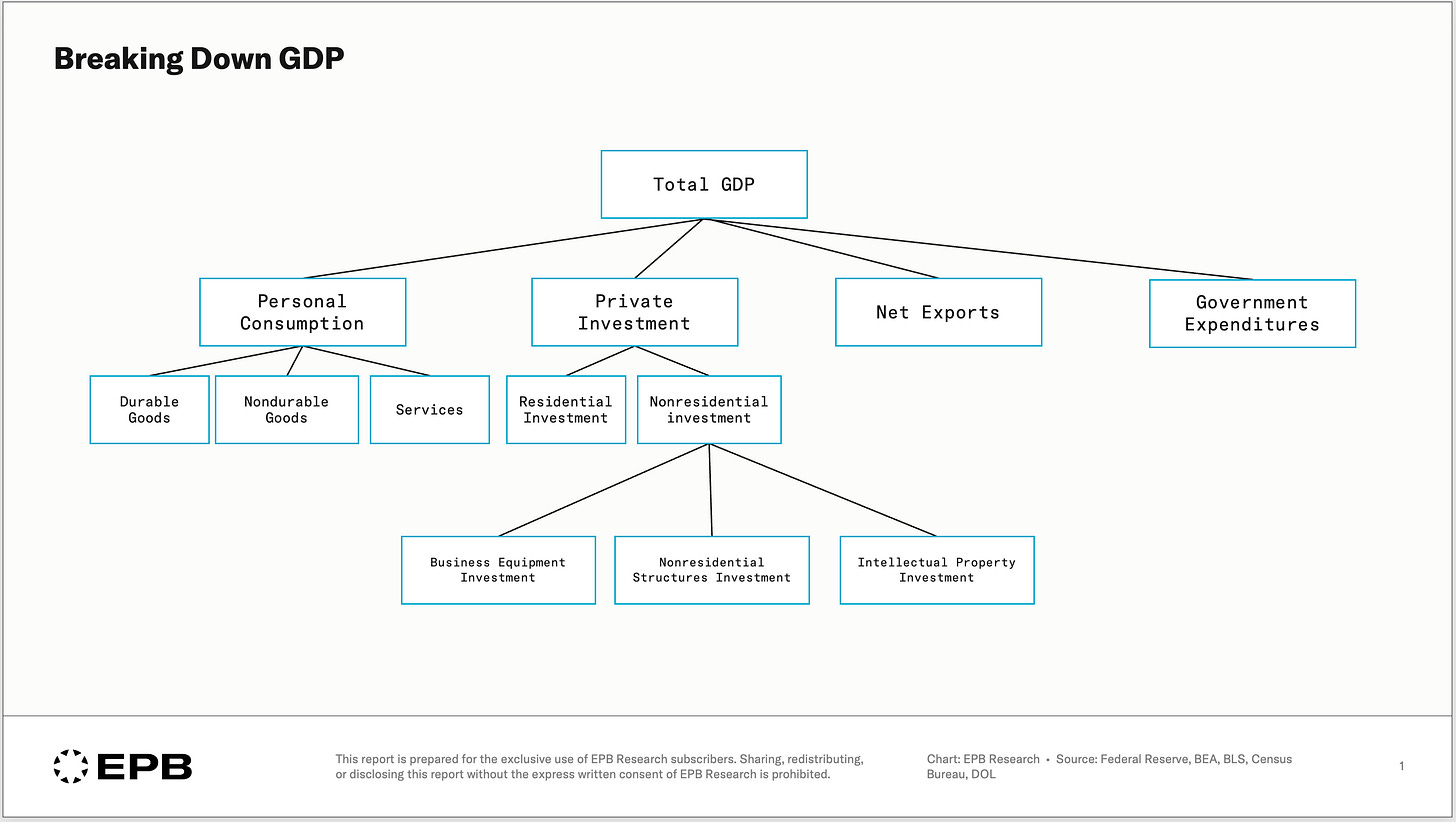

Breaking Down GDP

The economy has four primary categories: personal consumption, private investment, net exports, and government expenditures.

It’s true that personal consumption, or “the consumer,” accounts for about 70% of total GDP.

But that fact leads to an incorrect conclusion: that the consumer drives the ebbs and flows of the Business Cycle.

Within personal consumption, we have durable goods, nondurable goods, and services.

Within private investment, we have residential investment and nonresidential investment, which further break down into business equipment investment, nonresidential structures investment, and intellectual property investment.

Most analysts spend their time watching total consumption or total GDP. But not all of these categories behave the same way across the Business Cycle.

The Three Sectors That Actually Matter

The Duncan Leading Index was made popular by economist Wallace Duncan, and it was designed around a simple but powerful concept: changes in the economy stem from a few select categories.

The Duncan Leading Index involves tracking durable goods consumption, residential investment, and nonresidential investment.

At EPB Research, we’ve modified the original Duncan Leading Index to make it more cyclical and timely. We track three specific categories:

Durable Goods Consumption

Residential Investment

Business Equipment Investment

We call this combination “Cyclical GDP,” and it’s truly the only part of the economy you need to watch if your goal is to understand the Business Cycle.

In our modified version of the Duncan Leading Index concept, we exclude nonresidential structures investment and intellectual property investment from our framework.

That’s intentional.

These categories are not leading indicators, and in most business cycles, they’re lagging.

Nonresidential structures (hospitals, office buildings, shopping centers) often peak during a recession and bottom well after a downturn is over. Including them would add noise, not signal. These structures are less sensitive to short-term fluctuations in demand, having longer construction timelines, and include many government or quasi-government projects that are less sensitive to pure economic conditions.

Why These Three Categories Are All That Matter. Really.

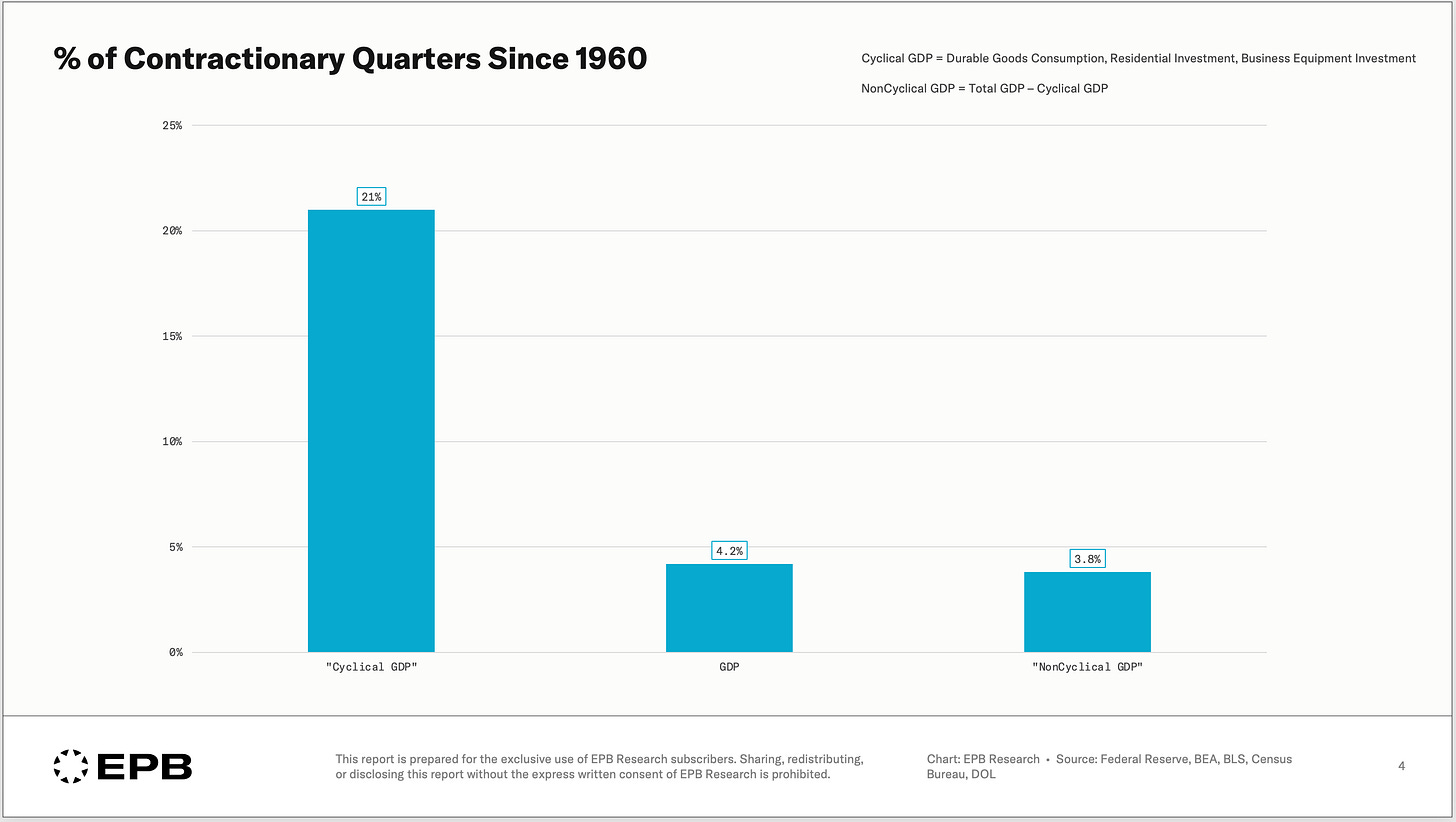

Most economic observers simply do not realize that the non-cyclical part of the economy, the part that comprises over 80% of GDP, almost never contracts.

Since 1960, Cyclical GDP has contracted in 21% of all quarters. Total GDP has contracted in just 4.2% of quarters. And the non-cyclical remainder? Just 3.8%.

All the signal is in Cyclical GDP. All the noise and the narrative is everywhere else.

By focusing on “the consumer,” you are really focused on an area of the economy that doesn’t often contract, other than the narrow slice of durable goods, which is the only segment of consumer spending worth devoting extra attention.

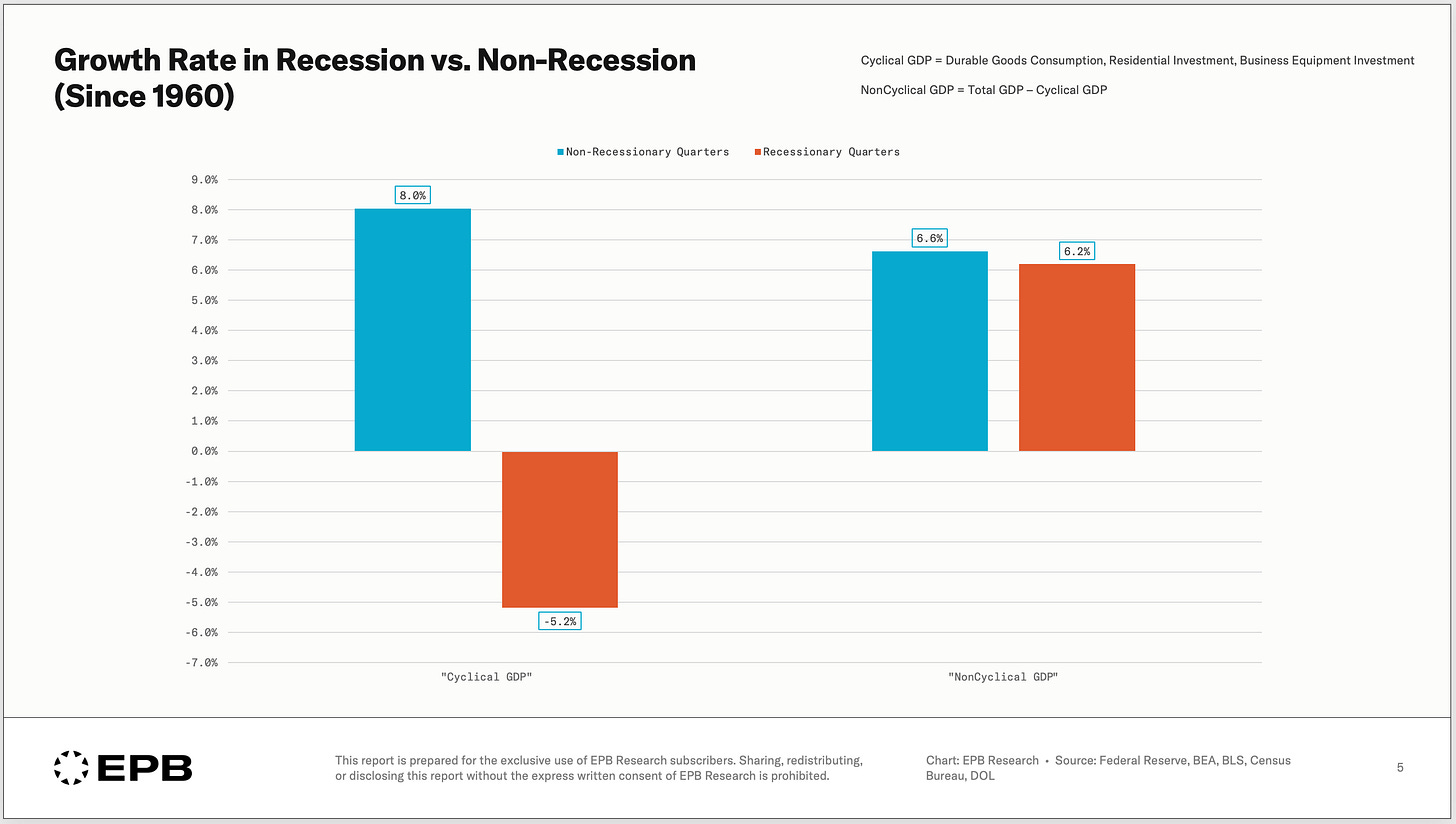

The difference becomes even more clear when we compare growth rates during recessions versus expansions.

During non-recessionary periods, Cyclical GDP grows at an average rate of 8.0% in nominal terms (including inflation). During recessions, it contracts at -5.2% on average.

Now look at Non-Cyclical GDP. During expansions, it grows at 6.6% on average. During recessions? It still grows—at 6.2%.

The consumer is almost always fine, right up until the moment they’re not. And by then, Cyclical GDP has already been flashing warning signs for quarters.

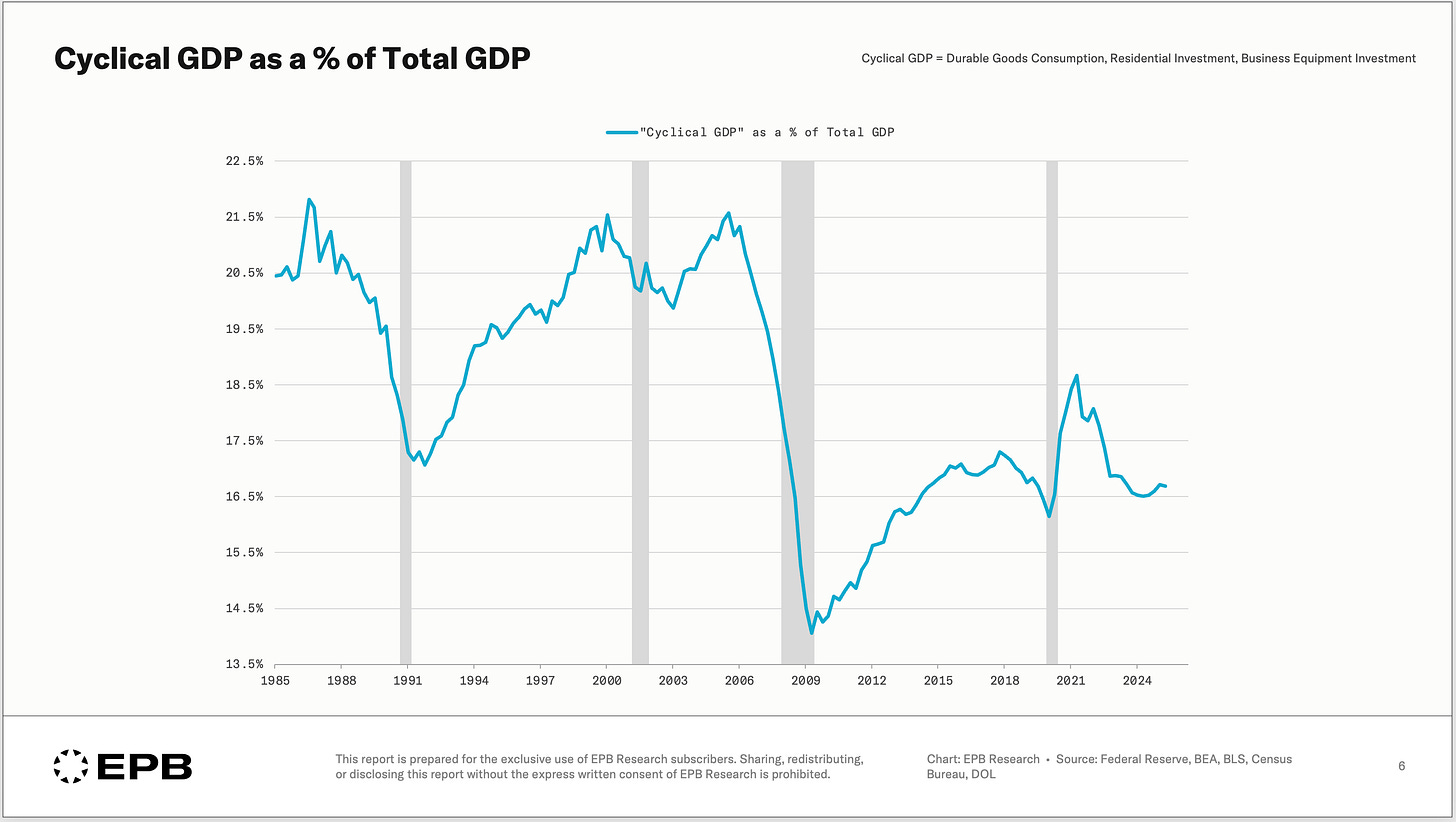

Cyclical GDP as a Leading Indicator

Importantly, Cyclical GDP, plotted as a % of total GDP, has been a historically reliable leading indicator.

As with all leading indicators, lead times vary. These are not stock market timing tools, but rather signals for when momentum in the economy shifts, helping to anticipate changes in monetary policy, corporate profits and trends in unemployment.

When the cyclical share of GDP starts declining, that is usually a signal that monetary policy tightness is slowing the interest rate sensitive parts of the economy.

Conversely, big increases in the cyclical share of GDP indicate an economy that has building momentum.

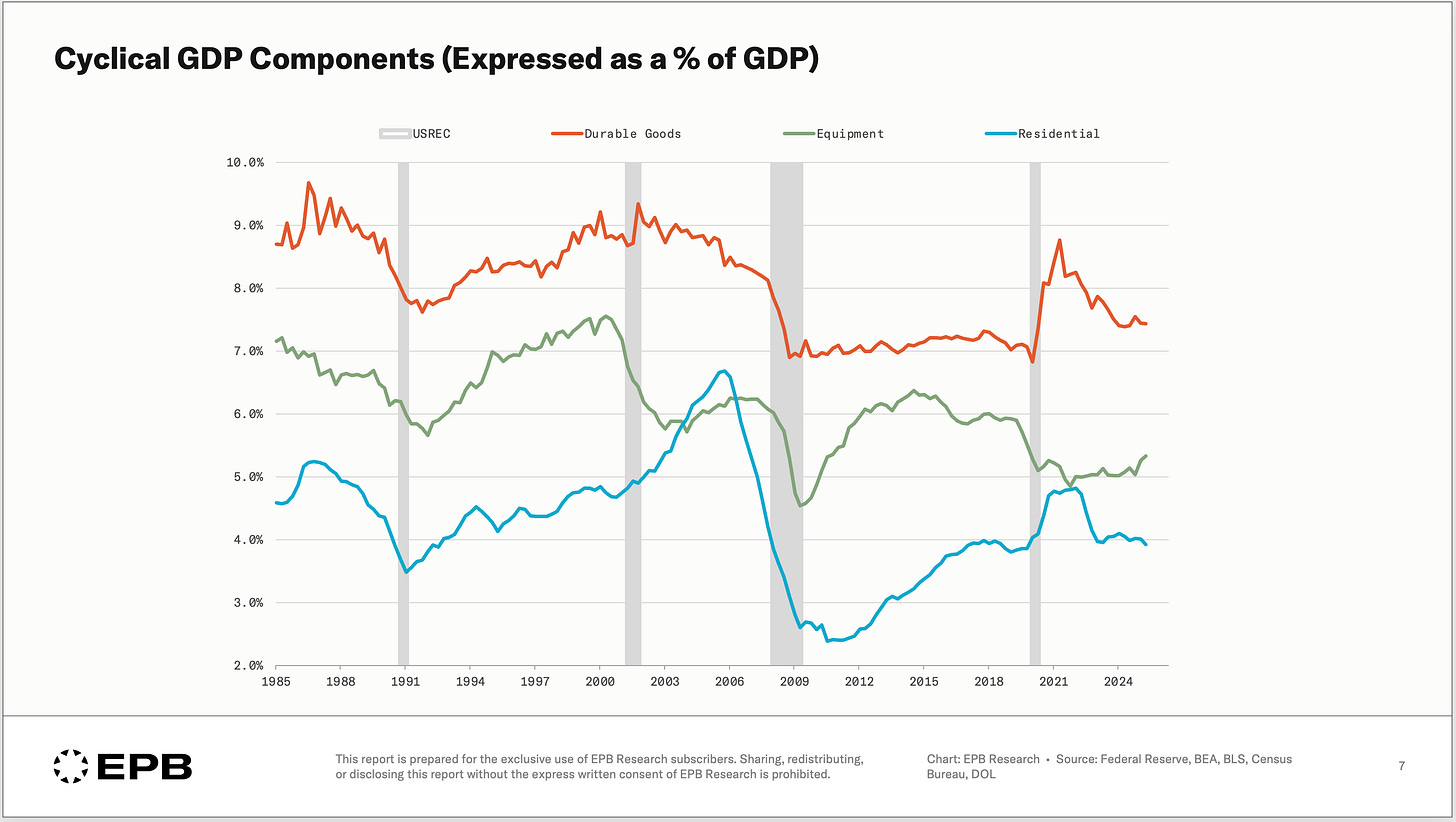

The chart below shows the three individual components of Cyclical GDP : durable goods consumption (orange), business equipment investment (green), and residential investment (blue) - each expressed as a % of GDP.

In many recessions, like the 1991 recession, all three components decline simultaneously.

In some recessions, like 2001, weakness is concentrated in one component, like equipment investment, while other areas such as residential investment remain strong. In these cases, recessions tend to be more mild and only occur when one component declines enough to offset the strength elsewhere in the Cyclical Economy.

The chart below is the same as above, but with the pre-recessionary periods highlighted for emphasis.

After the pandemic boom, the cyclical components experienced a hangover, mainly durable goods consumption, but over the last 2.5 years, there has not been much deceleration in the durable goods share or the residential share, and the equipment share has actually been rising.

While durable goods and residential investment have not been weak enough to create recessionary conditions (yet), the real story is the rise in equipment investment which is unusual in the face of a monetary tightening cycle.

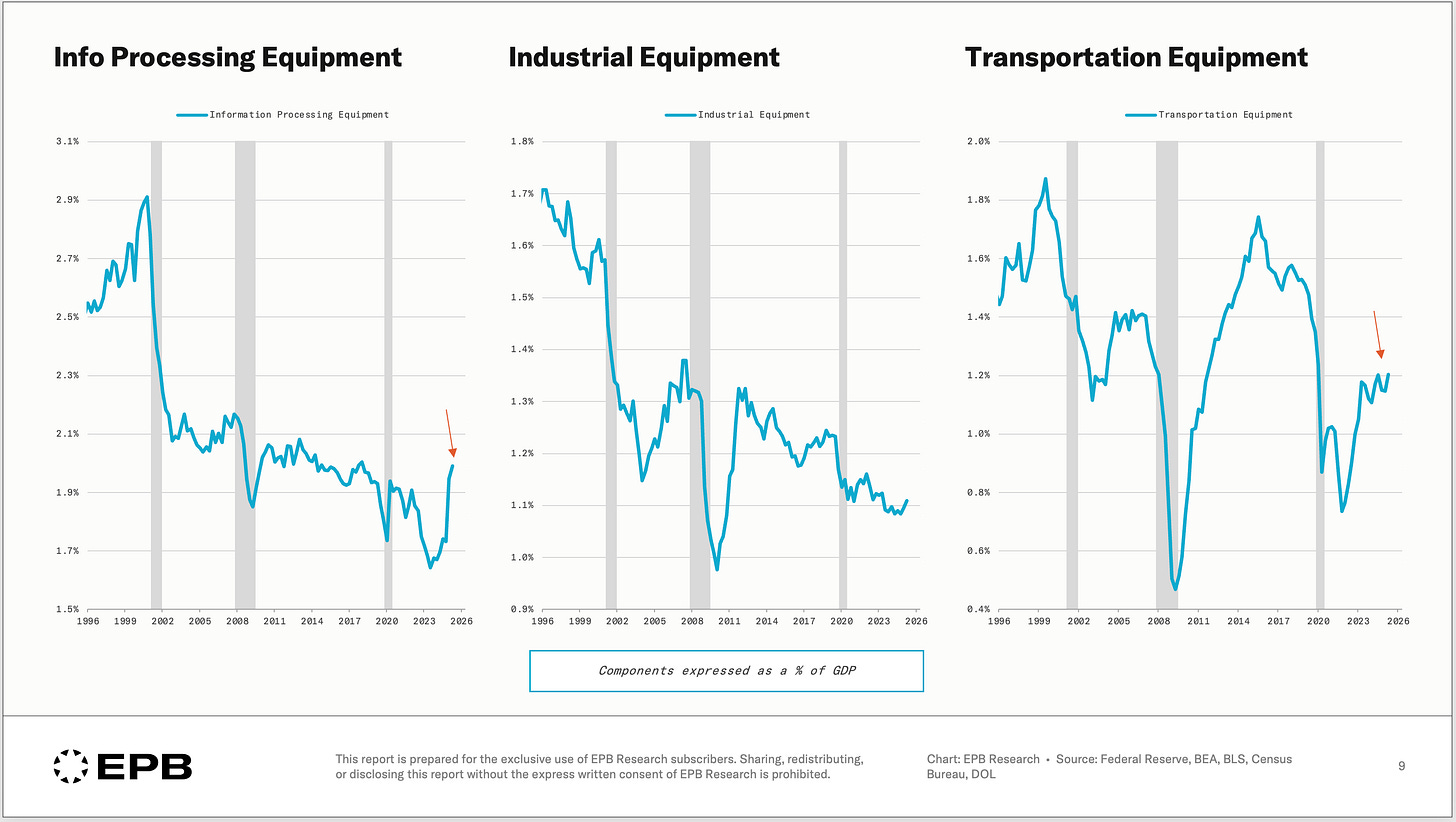

If we look at the main categories of equipment investment, we can see that there’s been a large upswing in information processing equipment and transportation equipment.

Information processing equipment is the AI story. Large capital expenditures for AI investment have driven an increase in computer and processing equipment.

While the AI story is a major driver of the strength seen in the broader equipment investment category, the rise in transportation equipment is also important and perhaps even more unusual.

Transportation equipment is highly cyclical but the normal sequence in this sector was disrupted during the pandemic supply chain crisis. Transportation equipment, a cyclical sector, collapsed as the economy was booming in 2021 and 2022 - a very unusual occurrence.

In 2023 and 2024, transportation equipment investment had to catch up even as the broader economy started to cool.

If we zoom in on the main categories of cyclical GDP, we can see stability in recent quarters for durable goods and residential investment but a surge in equipment investment.

Equipment investment has powered ahead on the heels of AI capital expenditures but also an unusual dynamic in the transportation sector that’s been unfolding since the early days of the pandemic.

The motor vehicle manufacturing sector is now shedding jobs so the residual strength in transportation equipment is almost certainly set to fade in the quarters ahead.

That leaves the AI story as the lone driver of equipment investment and the open question as to whether equipment investment can continue to rise and offset the flat-to-down trends we are seeing the share of durable goods consumption and residential investment.

Through the second quarter of 2025, we can see the nominal growth rate of the cyclical components of GDP is 5.7%, a healthy pace and one that precludes the economy from entering recession.

The fate of the economy in 2026 rests with the developments in the cyclical sectors.

The Bottom Line: Focus on What Moves, Not Just What’s “Big”

Most economic analysis is highly lagging and is reduced to nothing more than trend following because it focuses on the wrong things.

Total GDP, total consumption, or the aggregate labor market show where the economy has been or at best, where it is today, but certainly not where it’s going.

The three sectors that make up Cyclical GDP - durable goods consumption, residential investment, and business equipment investment - generate all the fluctuations in the economy.

This sequential breakdown of Leading, Cyclical, and Aggregate components of the economy is the foundation of the EPB Research framework.

We never react to headlines or random stock market gyrations. We track the sequential progression of the Business Cycle through the sectors that actually drive it.

Track the Cycle With EPB Research

This post is a snapshot and a high-level breakdown of how to track the Business Cycle using a consistent and repeatable framework.

EPB Research subscribers receive updates on the entire Business Cycle Sequence and more granular breakdowns of key themes like employment and inflation, so you’re always in a position to anticipate the next turn, not react to it.

If you found this analysis valuable, please share it with others who might benefit from a more rigorous approach to understanding the Business Cycle.

This still misses the bigger catastrophe: $1.7 trillion student loan debt, $1.2 trillion consumer credit card debt, $200 billion medical debt, $200 billion auto loan debt, $13.8 trillion housing market debt, 60% of population $1,000 away from catastrophe, 34% of the population under official poverty line. Real poverty rate considerably higher. All debt markets already seeing mass defaults. Graduate unemployment rate is increasing. Entry-level jobs cratering. Since bankruptcy protection was removed from student loans, student fees have gone up 1,500 percent. All unemployment rates increasing. This is the most indebted population in world history, in an 80% service economy, with the stock market of 1929, the housing market of 2007 & the tech bubble of 1999. GDP meaaures debt moving around and calls it growth. We're speeding toward the Titanic and no one is measuring the iceberg.

The Cyclical GDP framing works with that "consumer is doing fine" paradox. Recessions are hard to predict, even if they're already happening. I don't think we're in one, btw.