4.3% GDP Growth. Was It Actually Good News?

Why headline GDP growth masks a deeply bifurcated economy - and what it means for economic momentum/monetary policy in 2026.

The Q3 GDP report showed the US economy expanding at a 4.3% annualized rate. That is a strong headline number, but as with most headlines, the details reveal a more complicated economic picture.

At EPB Research, we separate the economy or GDP by categories of cyclicality. Some parts of the economy experience large booms and busts, while others are extremely stable, showing little difference in growth between recessionary and non-recessionary periods.

In a recent post, we discussed what we call “Cyclical GDP” and showed how 20% of the economy drives 100% of recessions.

Using the same framework, we can examine the Q3 GDP report in greater detail to identify the main drivers of the strong headline number.

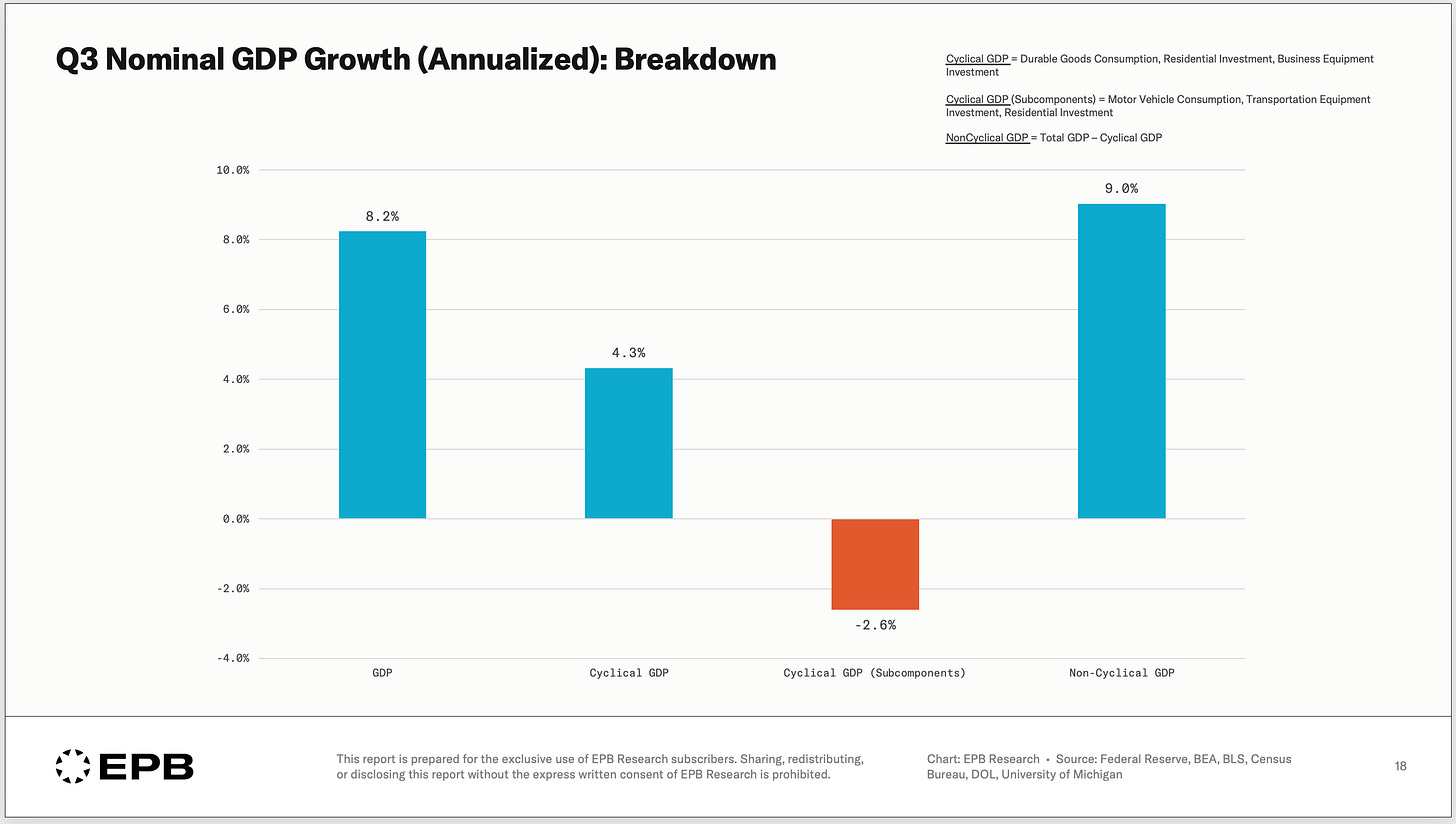

Nominal GDP clocked in at 8.2% in Q3, but it was powered almost entirely by the non-cyclical parts of the economy, which expanded at a 9% annualized pace.

Cyclical GDP grew at a 4.3% annualized rate in nominal terms, while the even narrower subcomponents of Cyclical GDP actually contracted at a 2.6% annualized rate.

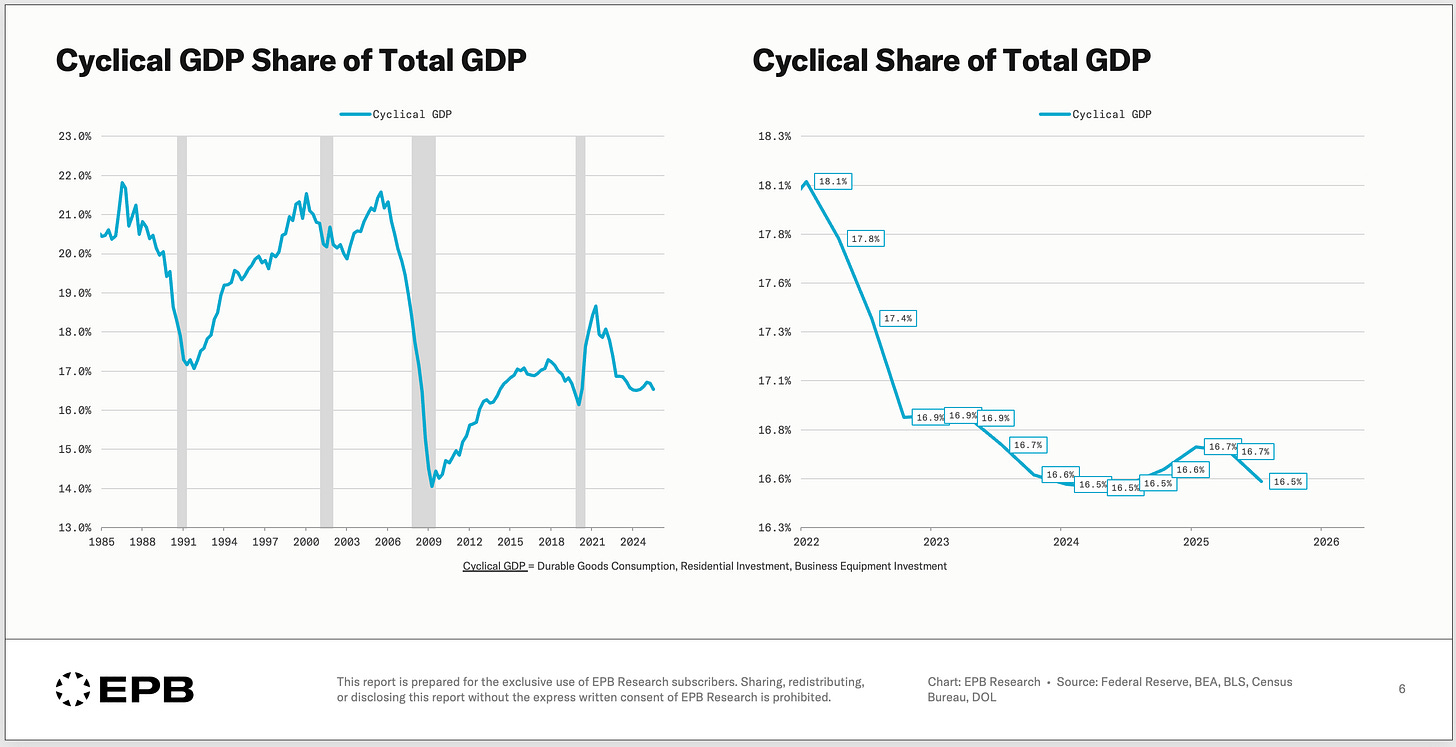

The cyclical share of GDP declined in Q3 after two years of stability. That stability has offset near-term recession risk, but negative momentum in interest rate-sensitive sectors resumed in the back half of 2025.

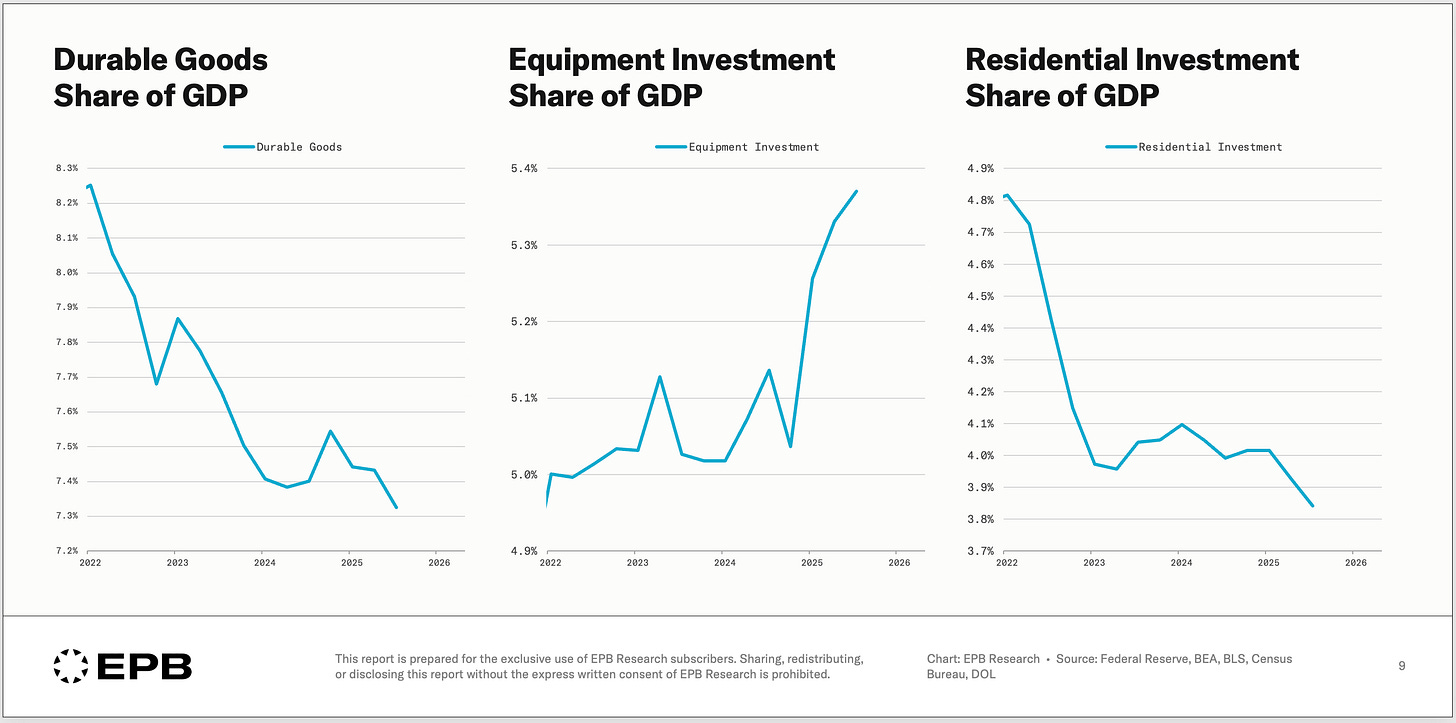

The divergence becomes even more striking when you decompose cyclical GDP into its three segments. Durable goods consumption and residential investment continue to struggle under the weight of higher interest rates. But equipment investment has been surging.

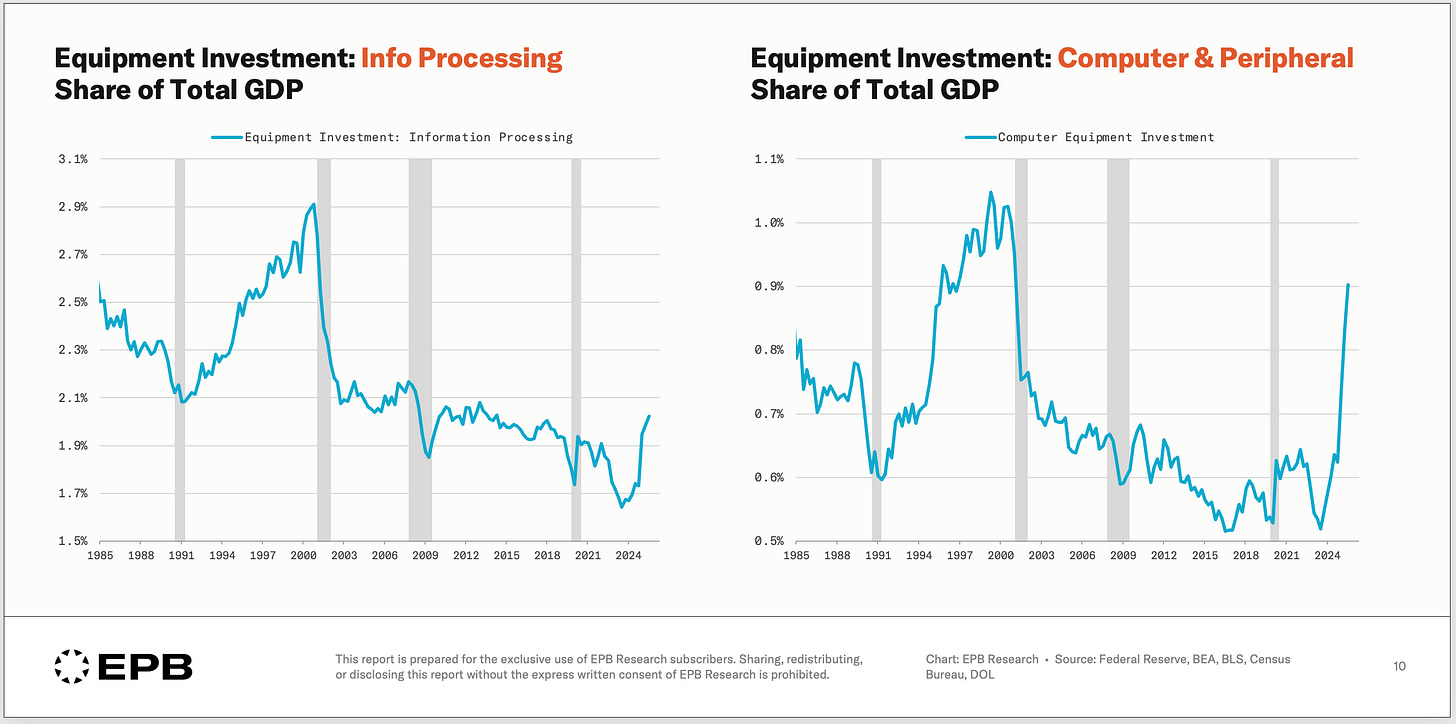

Specifically, business investment in computer equipment tied to the AI boom has shown remarkable growth rates, upwards of 50% in real terms in recent quarters, with its share of total GDP nearly doubling.

This growth is real and cannot be ignored. However, it’s clear that the AI-driven investment surge in narrow computer equipment is masking what would otherwise be a broad contraction in the traditional cyclical and interest rate-sensitive sectors.

This creates a challenging environment for monetary policy. Some sectors clearly need support, while others are printing historic growth rates. The Fed can't set one policy rate for two separate economic situations.

The Federal Reserve has penciled in just one rate cut in 2026. The gravity of negative momentum in the cyclical sectors may pose a challenge to that optimistic economic forecast.

The charts and framework behind this analysis are part of what EPB Research members receive every month, along with detailed coverage of the labor market, housing, and monetary policy.

Yes this is the issue. If the AI buildout and/or the equity market rolls over before there is a broad cyclical upturn, we got a problem. The risk is that it's just not clear where that upturn is going to come from.

Great work as always.

Great post. Would the aging population result in a further decline in the cylical components of GDP? It very well explains the less and less frequent recessions...